Media Room Lastest News

- Home

- Media Room

-

COPE Opportunities 2 identified as the top performing ASEAN-based private equity fund (all vintages)

October 18, 2019 -

CSR Project in Sapa village, Vietnam

May 24, 2019 -

SBIF, COPE Private Equity invest $14.25m in Malaysia-based MDT Innovations

April 15, 2019 -

Trends: Opportunities in the halal economy

March 24, 2019 -

PEI Awards 2018 - Top 3 Exit of the year in Asia

March 01, 2019

-

COPE Private Equity invests in Kinos Food Industries

December 27, 2018 -

COPE Private Equity wins 4 awards at the MVCA Dinner & Awards Night 2018

July 31, 2018 -

COPE organises ‘fruitful’ donation drive for IJN Foundation

April 23, 2018 -

Industry: Good PE investment prospects on the horizon

March 06, 2018 -

Malaysia’s COPE nears target for fourth fund

February 14, 2018 -

COPE Private Equity exits Serba Dinamik

January 29, 2018 -

CMS Opus Private Equity changes name to COPE Private Equity

January 12, 2018

COPE Investor Conference 2024: A Day of Insight and Forward-Thinking Discussions

COPE’s 13th investor conference, held on 20th June, was a resounding success, bringing together institutional investors, entrepreneurs, and advisers for a day filled with insightful discussions, valuable connections, and forward-thinking ideas.

The conference was opened by Dato’ Azam Azman, Founder and Managing Director of COPE. In his opening speech, he outlined COPE’s vision of nurturing SMEs and mid-tier companies into the blue-chip multinationals of tomorrow. He also emphasized COPE’s commitment to delivering outperformance to its investors, who indirectly serve millions of individuals.

One of the highlights of the conference was a presentation by Dr. Apurva Sanghi, World Bank’s Lead Economist for Malaysia. He shared a powerful insight: “Policy stability can be more important for a country’s economic growth than political stability.”

Prof. Dr. Aznan Hasan, COPE’s Shariah adviser, eloquently emphasized the harmony between Shariah and ESG. He argued that the application of ESG principles represents Shariah as it ought to be practised.

A panel session, moderated by Jeanette Lee, featured Ziad Razak from Ekuinas, Peng Yew Choy from Pet World, and COPE’s Senior Partner, Badrul Hisham Jaafar. The panel discussed the impact of private equity on the economy, highlighting the multiplier effect on the local supply chain from constructing a state-of-the-art factory, which was made possible through COPE’s investments.

Yoshiko Kubo of Preqin shared riveting market findings, revealing that Southeast Asia and India are the top two preferred emerging market investment destinations for LPs.

The conference also featured a lively discussion about the hurdles and opportunities in embracing digital transformation, represented by our portfolio companies and moderated by Gavin Tan.

We would like to express our gratitude to everyone who participated in this remarkable journey. We look forward to continuing to shape the future together.

Creador buys 40% stake in Malaysia's Pet World, COPE exits

By Justin Niessner, AVCJ

Malaysia-based Creador has acquired a 40% stake in prominent local pet food maker and brand owner Pet World, setting up an exit for COPE Private Equity.

Financial terms were not disclosed. Creador closed its fifth fund earlier this year at the hard cap of USD 680m. It writes cheques of USD 40 to USD 60m.

COPE backed Pet World in 2021 and described its value-add work as enabling the company to establish a world-class manufacturing plant in Shah Alam to meet growing local demand for pet food. During the holding period, the pet care segment of the business grew about 27% a year on the back of continuous product innovation and an entrenched distribution network.

Founded in 2006, Pet World claims to be the largest local pet food brand in Malaysia with brands such as ProDiet, ProBalance, and Delizios. It offers a range of products in both standard and premium formulations for cats and dogs. The distribution network covers more than 20,000 points of sale nationwide.

The company's monthly production capacity is 3,000 metric tons, and this is set to expand. Creador is also expected to be helpful in pursuing regional M&A opportunities to accelerate international expansion.

"Pet World's management team has shown exceptional capabilities by winning in an industry dominated by large multinationals," Brahmal Vasudevan, founder and CEO of Creador, said in a statement.

It marks Creador's 50th investment since its inception in 2011. In addition to Malaysia, the firm maintains bases in India, Indonesia, and the Philippines. Assets under management (AUM)amounted to about USD 2.1bn as of the close of Fund V.

Founded in 2005, COPE focuses on domestic middle-market companies that generate most of their revenues offshore in foreign currencies. Its fourth fund closed at MYR 275m (USD 64m) in 2018, bringing AUM to more than MYR 600m.

Read more here.

Malaysia’s COPE PE makes new investment, exits LGMS Bhd

By Nguyen Thi Bich Ngoc, DealstreetAsia

Malaysia-focused private equity firm COPE Private Equity has made a new investment from its COPE IV Fund and is expected to close another deal this quarter.

The company invested in Malaysia-based building and construction technology provider Dura Technology in Q4 2022, said COPE’s founder and managing director Azam Azman.

“It is not often that we see companies from Southeast Asia export technology to developed markets such as Australia, Canada, and China. What attracted us to Dura Technology was its ‘ultra-high performance concrete’, developed by a Ph.D. in structural engineering and lecturer, Dr Voo,” Azman said without disclosing the financial details of the investment.

Dura Technology’s product can be up to 4x stronger, 10x more durable, and 2x greener than other products, according to the PE firm’s executive. “We are partnering with Dura to increase its sales force, market penetration, and licensing business in new geographies,” he added.

After finishing another investment from COPE IV, which is anticipated to happen in Q1 2023, COPE will start marketing the fundraising of its fifth fund, Azman told DealStreetAsia.

COPE IV was closed at $70 million in 2018.

Azman had told DealStreetAsia in an earlier interaction that COPE V would also be open to investing in Southeast Asian businesses that have a Malaysian subsidiary or presence.

The firm’s other existing portfolio companies include Pet World International, Syarikat Logistik Petikemas, automation services provider UBCT Industrial Solutions, IoT enabler MDT Innovations, and launderette chain Cleanpro.

The firm typically looks at investing in firms that serve consumer necessities, such as food, logistics and utilities, as well as business necessities, such as production line automation and cybersecurity.

Bullish on exits

COPE recently exited cybersecurity services firm LGMS Berhad, an investment it made only last year, through the public market.

COPE chose to exit the firm as “it reached our expected exit valuation sooner than forecasted”, Azman said.

LGMS, which got listed on the local stock exchange in June 2022, has seen its share price rise as high as 88%.

Prior to this transaction, COPE had also exited precision metal component maker STX Precision, convenience fruit store retailer MBG Fruits, and clothing firm My-Sutera.

Azman said earlier that two of COPE’s investees were pursuing IPOs on the Singapore Exchange in addition to the local option.

“While the macroeconomic environment may influence the timing of exit if one intends to maximise return, we believe that the quality of the underlying businesses matters more,” he noted.

“Most of our investments are of a size where international buyers are included in the pool of potential buyers, in addition to local and regional buyers,” he said, suggesting that the avenues for liquidity in Southeast Asia are still open.

Read more here.

Middle East Investment Summit

Following the SuperReturn conference in September, COPE Private Equity participated in the Middle East Investment Summit in Dubai at the invitation of Capital Markets Malaysia.

Dato Azam, our managing director discussed the exciting private market opportunities in Southeast Asia with fellow esteemed panelists.

Given the region's youthful population, rising middle class, and skilled workforce, Southeast Asia is an attractive investment geography that remains under the radar of international investors. Despite having 9% of the world's population, Southeast Asia's PE allocation comprises less than 1% of global allocation.

Businesses in the region are vital players in the international supply chain and continue to be beneficiaries of the China Plus One policy. With the re-opening of the economy, the return of trade exhibitions and foreign tourists, and continuous innovations in technology, we are optimistic for private market returns in the decade ahead.

2022 SuperReturn Asia Singapore

After two years of travel restrictions, COPE Private Equity is happy to meet fellow private equity practitioners and investors from around the region during the 2022 SuperReturn Asia conference in Singapore.

Ms. Jeanette Lee, Senior Vice President of Investment shared her insights and experience during a panel session on cross-border investments, with a focus on COPE's successful exit from STX Corporation to a Japanese buyer in 2021.

Despite the challenges posed by the pandemic, since 2020, COPE Private Equity has successfully invested in four businesses and exited four. We hope to announce further investments in the coming months.

Malaysia’s COPE Private Equity sees economic downturn providing access to quality deals

By Yimie Yong, DealstreetAsia

Amid a slowing economy that has seen further disruption due to the COVID-19 pandemic, Malaysia’s COPE Private Equity sees an opportunity to access quality deals.

Business activities in Malaysia are resuming as the country gradually eased coronavirus lockdown measures. Almost all businesses are allowed to reopen, albeit subject to strict conditions, in the so-called conditional movement control order (CMCO).

Still, the World Bank has cut Malaysia’s 2020 GDP growth forecast to a negative 0.1 per cent, as stay-home orders froze economic activity for almost two months. Similar measures across the globe, which have slowed trade, further compound the challenges for Malaysia’s export-oriented economy.

“While COVID-19 is an unprecedented human tragedy which spares no one, the silver lining is that the economic downturn provides us access to quality businesses which may not otherwise be available,” COPE Private Equity founder and managing director Azam Azman told DealStreetAsia. “This access to quality deals, coupled with reasonable valuations and operational improvements, will hopefully work together to drive alpha returns over the next few years.”

COPE, which has invested in oil and gas companies such as the now-listed Serba Dinamik Holdings Bhd and Daya Material Bhd, also expects the downturn in the oil and gas sector to spur consolidation among industry players in Malaysia. However, the pricing gap between buyers and sellers may take time to narrow, said Azam.

COPE, which is also a Shariah-compliant private equity firm, will continue to favour sectors that fulfil large consumer needs such as energy, healthcare, education, food production, medical devices and engineering maintenance services, among others.

Established in 2005, COPE has 600 million ringgit ($138 million) of assets under management. Its portfolio includes aluminium and zinc die casting business STX Precision Group, fruit retailer MBG Holdings, school uniforms maker and distributor My Sutera Holdings, IoT company MDT Innovations and laundromat chain Cleanpro.

Read more here.

Fund managers to keep on investing

By Tee Lin Say, the Star

HOW the investment landscape has changed since February.

As Malaysia enters Day 53 of the movement control order (MCO), uncertainty and fear still permeates the economy. Over the past few weeks, the market has started hearing of businesses, particularly hotels, ceasing operations.

Most analysts have downgraded corporate earnings this year, with many expecting to see a contraction of 6% to 8%, followed by a sharp rebound next year.

While the stock market has recovered almost 15% from its low on March 19, at its current level of 1,386 points, it is still down some 12% on a year-to-date basis.

StarBizWeek spoke to private equity fund managers on how they view this pandemic and what sort of opportunities they see.

NICHOLAS BLOY

Managing Partner/Co-Founder

Navis Capital Partners Ltd

HOW is the current pandemic impacting your investee companies and your investment strategies?

Navis has a really well diversified set of portfolio companies, all of which we control and all of which have low leverage and plenty of cash.

So overall, we are in good shape. Some companies are really hurting – our restaurants, cinemas and fitness centres are all closed – so no revenues but at the same time our supermarkets, private hospital, medical and pharmaceutical businesses are all doing very well.

It’s a good example of why diversified portfolios are important.

We are also lucky that we have about US$1bil in cash to invest. There are many themes we are exploring that are unaffected or even accelerated by Covid-19: digital platforms, cybersecurity, home delivery and telemedicine, for example.

And, of course, there will be incredible bargains to be had in the industries most badly affected, for example, in the travel and tourism sectors

Are you in a position to help your investee companies receive more capital to stay afloat if necessary, or are you likely to decide to shut down businesses that have less chances of survival in this new norm?

We don’t believe we will close down any Navis business due to Covid-19, but there is a limit to our ability to incur losses from a lockdown.

At the shortest end, we have one company that would run out of cash in August 2020 if it cannot re-open. At the longest end, we have another business that can keep going until August 2021 with no revenues.

We are now in the fourth phase of the movement control order (MCO) period. From your perspective looking to invest into businesses, what do you think the government should be doing to ensure businesses are on a steadier footing?

Honestly, I think the government has handled things pretty well as we are in uncharted territory after all. But I feel that social behaviour no longer needs to be dictated by government. Everyone knows to distance themselves, wear face masks and so on. So the key is a predictable “unlocking” of different sectors of the economy with new SOPs where necessary, for example, how many people per available space.

Also, it would be helpful to know what is the government’s “second wave” strategy if that eventuates.

What is your personal strategy on the PE side? Acquisitions? Fund raising? Wait for opportunities?

We are investing. In the next couple of weeks, we will complete the acquisition of a large K-12 education business in one of the lesser-developed economies of South-East Asia.

In this country, there are not enough private school places for the demand that exists, so demand is pent-up. That’s an easy story against which to deploy growth capital.

Fundraising is more challenging as people cannot conduct their required due diligence. A lot can be done digitally and via video-conference, but almost every investor I know must visit the offices, meet the team, visit a few portfolio companies and so on.

Do you feel the world has changed since Covid-19? Is it really a new normal or do people revert to old habits after awhile? With that in mind, are there any sectors or markets you are eyeing?

Covid-19 has accelerated a number of trends that have or will soon reach a tipping point where before Covid-19, they could be considered a fad or a niche but which will become mainstream faster than before.

Navis has a very clear framework around what these are. I will give some obvious examples. Home delivery and click-and-collect for supermarket businesses, online education . . . and a less obvious example would be plant-based cuisine but we have about 30 areas under investigation.

DATUK AZAM AZMAN

Founder and Managing Director

COPE Private Equity

Covid-19 and low oil prices have rendered global markets a lot lower than what they were in February. What is your outlook for the economy, moving forward? On this note, do you also see opportunities because of cheaper valuations?

When we look back a few years from now, 2020 will be remembered as an unprecedented event that shaped our generation, a titanic battle between human mortality and economic sustainability.

In terms of opportunities, our investment team has been working overtime in identifying quality and scalable businesses to invest in. Yet, despite the de-rating of public markets, sellers tend to cling to “yesterday’s price” so deal-making may be challenging in the near term until valuation adjusts to the new reality.

Is it really a new normal or so people revert to old habits after awhile? With that in mind, are there any sectors or markets you are currently eyeing?

In an uncertain economy, everyone can see the first bounce – the economic fallout.

Entrepreneurs, and those backing them, who can best predict the second bounce in the economy will emerge stronger from the crisis. Selecting winners for the second bounce is what good PE thrive on to deliver consistent alpha returns.

We continue to favour sectors that fulfil large consumer needs such as energy, healthcare, education, food production and peripheries, like medical devices and engineering maintenance services.

We are looking to back agile and forward-thinking entrepreneurs – businessmen who recognise opportunities in a crisis, coming up with new products and distributing through new channels to meet changing consumer demand.

What are some of the indicators you would like to see before putting money more convincingly into businesses?

From a macro point of view, we try to be ahead of the curve, emphasising investments in times of heightened risk aversion and emphasising exits when the economy is booming.

The micro view of each business franchise is even more important. We prefer businesses which are leaders in their industry, entrepreneurs who understand the importance of branding, deploy proprietary technology and are regional in outlook.

The perfect business does not exist but from our observation, successful businesses have a significant combination of the above.Siau: Any crisis will always present the best investment opportunities.

Siau: Any crisis will always present the best investment opportunities.

ANTHONY SIAU

Managing Partner

Kairos Capital Singapore

How is the current pandemic impacting your investee companies and your investment strategies?

We are very selective in our investments, most of our portfolio of investee companies are affected in one way or another, but they are also very resilient.

We recommended them to preserve cash during this turbulent time and to manage their businesses prudently.

Any crisis will always present the best investment opportunities.

We are now in the fourth phase of the MCO. From your perspective looking to invest into businesses, what do you think the government should be doing to ensure businesses are on a steadier footing?

On hindsight, with its limited resources and political turmoil, Malaysia has done relatively well in the containment of Covid-19. The way forward is to ensure that the containment efforts remain vigilant, even as the country starts to open-up the economy.

But it should be done with a comprehensive execution plan rather than haphazard announcements.

The recent debacle on the hire-purchase interest charges should not have happened if coordination is well-oiled and communication is flowing.

That is a lesson the ruling government should take a page out of New York governor Andrew Cuomo’s book, communicate clearly with facts and science, no ambiguity or vagueness. Also this is not the time for politics.

What is your personal strategy on the PE side? Acquisitions? Fund raising?

Personally, I am actively looking for investible assets at attractive valuations, particularly focusing on late stage opportunities. I won’t hesitate to invest in leaders of fast-growing markets at a depressed value inflection point, especially during this current market downturn.

As for fund raising, even as most investors are flushed with cash as compared to the last couple of downturns, most of them are cautious in their investment decisions but I welcome any like-minded investors who share my outlook to invest together, there are opportunities abound.

The country has been attacked on oil prices and crude palm oil (CPO) prices. Politically it’s uncertain too. Are you optimistic on Malaysia?

Oil and CPO prices are seasonal and political. The low-price environment will eventually ride its course, similarly for Malaysia’s economy.

However, the political impasse must end. It is by far the biggest impediments to Malaysia’s growth trajectory as the rakyat is extremely weary of the political uncertainties.

As a Malaysian residing overseas, I am optimistic on the country’s future as long as it is governed by an administration that prioritises the rakyat’s interest above its own.

Read more here.

Private equity funds eye deals with SMEs in South-East Asia

By Risen Jayaseelan, the Star

AMIDST the difficult economic conditions faced by entrepreneurs, some private equity funds are looking for new deals. Some entrepreneurs are wary of striking deals at this point, considering the weakened situation they are in.

But to the private equity funds, what they are offering is a lending hand to promising entrepreneurs who are likely to do well, post the Covid-19 crisis.

Local firm COPE Private Equity has launched a fund of up to RM40mil called the BOW programme, which stands for ‘Bridge Over Troubled Waters.’

“Facing rapid sales decline and supply chain disruptions, many entrepreneurs need assistance beyond the loan moratoriums and government assistance, ” says the firm in a statement.

Datuk Azam Azman, the founder of COPE, says they are looking to fund “ambitious entrepreneurs” who, when the recovery arrives, will be “well-funded and be the first one off the block in launching new products and winning market share.”

Similarly, Dymon Asia Private Equity, which is investing its second fund of RM2bil in SMEs across South-East Asia, is offering its money and experience to entrepreneurs.

“We have some experience funding strong companies that are temporarily hampered by one-off events, ” says the fund’s partner Tan Chow Yin.

However, from the standpoint of entrepreneurs, the issue of whether they will be getting best value in any funding deal in today’s climate remains a big concern.

“With private equity firms, we are unsure if we will be pressured to give up equity for cheap, and we are concerned about who maintains executive decision-making powers in our company as the investee company, the cultural fit of the investor company, ” says a tech firm.

On this concern, COPE’s Azam says, “Over the past 15 years, we have invested based on the spirit of partnership or ‘musyarakah’ to arrive at a fair and profitable outcome for both parties. We do not intend to change our approach, nor do we intend to take advantage of the current situation to structure one-sided deals.”

He adds that businesses stand to benefit from substantial capital injection, “relieving their cashflow pressure from having to sell assets and intellectual property for cheap. The additional financial resources will enable these businesses the ability to invest, retain and attract talents and pivot their business strategy to respond to changing customer behaviour, providing them an advantage over competitors.”

Dymon’s Tan explains that if it is a buyout, it requires mutually acceptable valuation and if the investment is a minority stake, private equity investors are more flexible as their investments are interim and finite.

“Investments, especially minority stakes, can be structured where there are redemption features or conversion options depending on how the business does. In general, as the business does better, the entrepreneur will have more flexibility to decide on whether to exercise on some of these features.

“Private equity investors may also be concerned that they are not short-changed when a business does really well, or over-exposed when a business does really poorly. Hence there will be protection mechanisms as well.”

COPE Private Equity is looking to invest in sectors that fulfill large consumer needs such as energy, healthcare, education, food production and peripheries, like medical devices and engineering maintenance services.

Meanwhile, Dymon Asia Private Equity invests across various sectors and have in the past invested in healthcare, education, consumer staples, food and beverage services and retail, engineering services as well as niche manufacturing, with preference for less regulated industries.

Dymon Asia Private Equity was founded in 2012 to invest in SMEs across Southeast Asia.

Tan says the first fund did very well and by early 2018 it had successfully returned its investors’ capital and presently still sitting on strong returns. It is currently investing its second fund, a US$450mil (about RM2bil) fund.

"The fund is a 10-year closed-end fund and since we raised it 2 years ago, is relatively new. Covid is certainly an unprecedented situation and we have never experienced anything like this in the past. However, we do have quite some experience funding strong companies that are temporarily hampered by one-off events.

"More important than funding is our focus on working alongside the entrepreneurs and management teams to grow the business further together," Tan adds.

Read more here.

COPE Opportunities 2 identified as the top performing ASEAN-based private equity fund (all vintages)

Preqin, the leading data provider for the alternative assets market has recently published ‘Top of the Table: ASEAN PE & VC’ in which COPE Opportunities 2 was identified as the top performing fund.

COPE Opportunities 2 is a vintage 2012 growth equity fund with net IRR of 43.2% as of Q1, 2019.

Please refer to the original publication here.

CSR Project in Sapa village, Vietnam

On the 19th of April 2019, 16 of COPE Private Equity Sdn Bhd’s employees including Dato Azam Azman, the Managing Director, Tuan Syed Alsagoff and Mr Peter Chin visited Diem Truong Thao Hong Den, a school located in the mountainous village of Sapa, Vietnam housing 180 H’Mong children aged 6 to 10 and 8 teachers.

Employees of COPE were given an opportunity to interact and engage with the children throughout the hour-long game-playing session. The children, donned in colorful handsewn ethic costume performed several dances to local songs and gave the staff a sneak peek into their unique culture. Gift bags containing school kits like water bottle, pencil cases, and socks were given to all 180 children at the end of the visit.

COPE staff was extremely appreciative of the experiences and humbled by the welcome they received from the school. Each left the place with renewed appreciation of the privilege the city dwellers enjoy but often take for granted.

As a private equity house, the business is drawn upon a capitalist view about the world but deep inside the private equity practitioners there is the socialist view that must be taken into consideration as well. This will make up a well-rounded private equity team. Our engagement is not only for the local community, but we look at ASEAN countries as well.

Our next project is a food truck project that will enhance the traffic flow to the local mosque and help the local community regardless of race or religion. We hope this project will portray the diverse background of Malaysia and how we have lived prosperously as a showcase for other countries in the ASEAN region.

SBIF, COPE Private Equity invest $14.25m in Malaysia-based MDT Innovations

By Ka Kay Lum, DealStreetAsia

SBI Islamic Fund II (Brunei) Limited and Malaysia’s COPE Private Equity have jointly invested up to $14.25 million in Malaysia-based MDT Innovations, the latter said in an announcement on Monday.

The capital will be used to support MDT Innovations’ research and development, enhance its product quality, expand its business and maintain its competitive edge as it seeks to become a market leader in the Internet of Things (IoT) industry.

Founded in 2004, MDT Innovations focuses on IoT value chains ranging from intelligent wireless communications, IoT as a service, to neutral network solutions, the company offers services in the key domains such as crowd movement, things management and fintech enablement.

“We are pleased to be partnering with COPE and SBIF II, two leading institutions to support the growth of MDT Innovations. We believe MDT Innovations is uniquely positioned to tap the huge market that is IoT in Asia-Pacific,” said MDT Innovations CEO Liew Choon Lian.

COPE Private Equity managing partner Azam Azman commented: “MDT Innovations is a Malaysian company with world class technical know-how in the IoT industry. We are excited to partner with Liew and his talented team and look forward to support their growth in the years to come.”

The investment was made out of COPE Private Equity’s fourth fund. DEALSTREETASIA had reported that the vehicle, COPE Opportunities IV achieved its final close at $70 million in October 2018. The firm will be looking at a trade sale or IPO for some of its portfolio companies this year. COPE IV will be cutting check sizes between $5 million and $20 million – a relatively under-served market segment within Malaysia – with a typical holding period of three to five years.

The fund was launched in 2016 and had a first close at RM200 million ($48.2 million) last October and a second close at RM275 million ($66.3 million) early this year. Its predecessor, a 2013-vintage vehicle, COPE Opportunities III, was closed at RM80 million ($19 million) and has been fully deployed.

Meanwhile, SBI Islamic Fund II is a shariah compliant private equity fund managed by SBI (B) Sdn Bhd, a joint venture fund management company established by Brunei’s Ministry of Finance and Economy (MOFE) and Tokyo-listed SBI Holdings Inc. One of the LPs of the fund which has the mandate to invest into a diverse range of late-stage companies across Asia is Jeddah-based Islamic Development Bank.

Read more here

Trends: Opportunities in the halal economy

By Khairani Afifi Noordin, The Edge Malaysia

The word “halal”, or what is deemed permissible in Islam, used to be applied to mainly food and drink. But today, it encompasses a much broader area of products and services, including healthcare, travel and tourism, financial services, pharmaceuticals and cosmetics.

The halal economy is huge and is set to grow even further. At the World Halal Conference 2018, Sultan Nazrin Muizzuddin Shah of Perak said the global halal industry was projected to grow to more than US$6.7 trillion by 2020.

This is in tandem with the anticipated increase in the number of Muslims to nearly three billion by 2060 from 1.8 billion in 2015, according to Pew Research Center. Muslims are expected to make up more than 31% of the world’s population by 2060, it adds.

Despite the current size of Muslim consumer market, investments in companies that cater for this population — especially smaller, high-growth ones — are scarce, says Thomas Tsao, co-founder and managing partner of China-based venture capital firm Gobi Partners. The problem, he observes, is that the market is fragmented and investors would rather put their money elsewhere.

“Big Muslim economies do not lack capital. However, instead of investing in their own communities, they would rather do so in some random Silicon Valley-based company. There are so many deals happening in the Muslim [start-up ecosystem] that it is ridiculous to think that institutional investors could not find any good deals here,” says Tsao.

He first saw this gap in 2015, when Gobi decided to set up an office in Kuala Lumpur to focus on investments in Asean. Having been based in Shanghai for 13 years, Tsao thought that he understood Asia and knew which types of companies would succeed in the region. However, he found out later that he did not know this region very well after all, especially when assessing potential companies in which to invest.

“One of the first few companies that I met here sells wine online. This got me really excited because I know there is a company called YesMyWine in China that had done very well and even became the country’s biggest online wine retailer. But then, people told me that it would not work here [in Kuala Lumpur] because Muslims do not drink,” says Tsao.

“When I thought about it, I realised that a lot of businesses would not work [in this part of the world]. For example, pet-related companies because Muslims generally do not keep dogs as pets.

“Muslims are the majority in this country. So, not having them as clients means that you are losing a sizeable market share.”

After doing some research, he came up with TaqwaTech, an investment vertical that targets innovative start-ups offering products and services that cater for the Muslim population. The term does not necessarily mean halal or shariah-compliant, but it does mean that purpose-driven innovation can be applied to Muslim economies, says Tsao.

Under this vertical, Gobi has made investments in several companies that cater for Muslim consumers such as online travel agencies (OTAs) Tripfez and Sastaticket.pk, food technology companies Offpeak and Qraved and charity platform SimplyGiving.

While Tsao has not exited any of the companies yet, his initiative has received some validation. Last November, it was announced that Tripfez had merged with Middle Eastern OTA Holidayme to become one of the largest Muslim-friendly OTAs in the world.

The newly merged entity is building a next-generation Umrah solution to cater for potentially 30 million Muslim pilgrims by 2030. It plans to roll out the solution in Malaysia and Indonesia when it is ready.

Gobi has more than 100 investee companies in its portfolio. Tsao is actively looking for more companies to invest in and is in discussions with several parties. The firm is close to announcing some new deals in other Muslim-majority countries.

“My job is to see trends. That is what early-stage venture capitalists are — the antennae of society. I believe that the opportunity for TaqwaTech investments is bigger than I can imagine. Technology breaks down borders. With tech, companies are able to serve a larger audience, not necessarily just Muslims,” says Tsao.

Gobi is not the only player to have noticed this gap. In 2017, Bintang Capital Partners — the private equity (PE) arm of Affin Hwang Asset Management Bhd — and Singapore-based CMIA Capital Partners Pte Ltd jointly acquired a controlling stake in Bitsmedia, the company behind the world’s most popular lifestyle application for Muslims, Muslim Pro. The transaction marked the world’s first buyout of such a company by a PE firm.

Akmal Hassan, Managing Director of AIIMAN Asset Management Sdn Bhd, says when Bintang saw the investment opportunity a few years ago, few investors were keen on Bitsmedia’s business model. Bintang was keen to invest in the business so that the company could be taken to the next level.

“The app is capable of a lot of things beyond showing users prayer times and the kiblat (direction of Mecca). The app has been downloaded more than 50 million times. There are 11 million active monthly users and more than 2.5 million active daily users,” says Akmal.

“If Muslim Pro ties up with another Islamic entity, the app will surely be able to do a lot more and Muslims will benefit from that. This was the growth potential that we saw.”

He thinks that the uptake of such investments will be slow but steady. For these investments to grow exponentially, there needs to be a more supportive ecosystem as there are limitations currently, he adds.

“If we had a better, more supportive ecosystem, I think the prospects for investments in companies that cater for Muslim consumers would be very positive. I believe the demand is there and I think the governments of other Muslim-majority countries are doing something to push for it as well.”

Shariah-compliant approach

Typically, investors do not go out of their way to look for halal companies or those that cater exclusively for the Muslim population. What they do instead is look for shariah-compliant investments. This is usually done via negative screening.

Even then, there are few shariah-compliant venture capital or PE players in the region. One of them is Malaysia-based Cope Private Equity. Its managing director Datuk Azam Azman says the lack of shariah-compliant PE fund managers is due to supply and demand.

“From the supply side, for a PE fund manager to be considered investable by institutional investors, the team would have to offer a coherent investment strategy, proven track record and a strong and experienced team. Given the young PE industry in the region, one would have difficulty finding PE fund managers with these criteria. And even less so, those who only do shariah-compliant investments.

“From the demand side, most institutional investors would prioritise PE fund managers with the ability to deliver good returns, ahead of a fund being shariah-compliant. Very few institutional investors would take the risk of backing a first-time shariah-compliant fund. Thus, it is unsurprising that few PE fund managers invest using purely shariah principles.”

COPE invests in several shariah-compliant companies, including Kinos Food Industries Sdn Bhd, a halal-certified snack and confectionery manufacturer. As the halal industry in Malaysia is more concentrated in the food and beverage sector, there are investment gaps in other sectors, says Azam.

“Nestlé and Ajinomoto, for example, use Malaysia as a halal hub and export to other parts of the world, including the Middle East. What is less developed is halal products for other sectors such as cosmetics, personal care and pharmaceuticals as well as halal e-commerce and travel services. We expect more investments in these sectors as we see pent-up demand among the Muslim community.”

He adds that the global halal industry is relatively young. In Malaysia, the industry started in 1974 with the issuance of the first halal certificates. “[However], we would like to emphasise that halal should not be a Malaysia-centric investment spectrum. Rather, it must be viewed from a global perspective as consumers transcend national boundaries and ethnicities,” says Azman.

While halal businesses are a natural constituent of Cope’s portfolio and the firm is looking forward to making more investments in leading halal companies, it will not invest in a business just because it is halal, says Azman. The products and services offered by the business have to be high quality, cost-competitive and meet customer requirements, he adds.

Richard Foyston, chairman of Navis Capital Group, concurs. He thinks good shariah-compliant and non-shariah-compliant companies bear the same qualities. Apart from good fundamentals, they need to have good market focus, brand awareness and distribution, he says.

“I do think there is growing interest and awareness of the halal market, but I do not think easy money can be made there. The fundamental basis of a halal business is more or less the same as that of regular businesses,” he adds.

Founded in 1988, Navis runs one of Southeast Asia’s largest PE funds. It also manages the Al-Bahhar fund, the shariah-compliant equivalent of its public equity fund Navigator.

“We have a lot of experience with the shariah-compliant segments of the market and we make sure that the companies in our shariah fund are shariah-compliant and will stay that way. While we do not go looking for only halal businesses, we do have to make them shariah-compliant at times. For example, when we invested in a restaurant business in Australia, where the halal market is relatively small, we were able to change the menu so that it became shariah-compliant,” says Foyston.

It is interesting to note that shariah-compliant investing has received a big push recently due to its overlap with ethical investing, he adds. “By investing in shariah-compliant assets, investors with a mandate for ethical investments are able to avoid investing in companies that are ‘harmful’ in nature. That is the primary reason for investing in shariah-compliant funds for a growing number of investors.”

Read more here

PEI Awards 2018 - Top 3 Exit of the year in Asia

On 11 December 2018, Private Equity International, a global private equity publication with offices in London, Hong Kong and New York shortlisted COPE Private Equity’s exit from Serba Dinamik as Exit of the Year under the Asia-Pacific category.

COPE made its investment in Serba Dinamik in June 2013 and fully divested its stake in January 2018. Over the period of COPE’s investment, Serba Dinamik grew its revenue 4.9-fold and net profits 5.3-fold.As at 31 December 2018, the market capitalisation of Serba Dinamik was RM5.5 bn.

The award is voted by industry peers and the winners were announced on 1 March 2019, with COPE winning third position alongside industry behemoths Barings Private Equity Asia (AuM: USD11.0 bn) and Partners Group (AuM: USD75.0 bn).

COPE Private Equity invests in Kinos Food Industries

COPE Private Equity and Kinos Food Industries (M) Sdn Bhd (“Kinos”) announced the completion of a MYR15.0 million investment into Kinos.

COPE Private Equity and Kinos Food Industries (M) Sdn Bhd (“Kinos”) announced the completion of a MYR15.0 million investment into Kinos.

Kinos is an established company in snack confectionery and distribution with 35 years of history. The company owns an assortment of iconic household names such as Kinos, Nini, Tora, Ding Dang, Hiro and Mizu whichare popular among children of successive generations. In recent years, the company expanded into potato chips manufacturing to grow a larger segment of export markets.

From its production plant in Pasir Gudang, Johor, Kinos distributes its products to 25 countries around the world, with 45% of sales generated outside Malaysia.

Dato’Sri Liew Yew Chung,CEO of Kinos Food Industries, said: “We are delighted with the confidence COPE Private Equity has in our vision to grow the brand and business, creating many happy memories for children and adults alike by producing the highest quality snacks.”

Dato’ Azam Azman, Managing Partner of COPE Private Equity, said:“Kinos manufactures many of our favourite childhood snacks. We are excited to partner with Dato’ Sri Liew and look forward to supporting Kinos’ regional growth in the years to come.”

COPE Private Equity made the investment from COPE Opportunities IV Sdn Bhd.

COPE Private Equity wins 4 awards at the MVCA Dinner & Awards Night 2018

2017 proved to be a fruitful year for COPE Private Equity Sdn Bhd (“COPE”) and its portfolio companies.

During the MVCA Dinner & Awards Night 2018, which was held on 31 July 2018 by the Malaysian Venture Capital Association (MVCA), both STX Precision Corporation Sdn Bhd and Serba Dinamik Holdings Berhad won Outstanding Investee Company of the year awards, with a 3-year Profit After Tax CAGR of 42.8% and 40.2% respectively. Both companies demonstrated tremendous growth numbers thanks to good management practices and higher export or foreign based revenue contribution.

COPE also won the award for Best Exit in 2017 for Serba Dinamik Holdings Berhad, with IRR of 79.2% and money multiple of 8.9x. For COPE Opportunities IV Sdn Bhd, COPE won the Best Funds Raised in 2017 award. COPE is grateful for the industry recognition given by MVCA.

For the rest of 2018, COPE will be actively looking for ambitious and fast growing companies to partner with and value add. Several promising companies have been identified and are under evaluation. COPE is also preparing some of its investee companies for potential exits.

COPE organises ‘fruitful’ donation drive for IJN Foundation

Premium fruits by MBG for sampling and purchase by guests

Premium fruits by MBG for sampling and purchase by guests

On 23 April 2018, COPE Private Equity Sdn Bhd (Formerly known as CMS Opus Private Equity Sdn Bhd) organised a Durian & Fruits Party in Kuala Lumpur for the benefit of the IJN Foundation. The foundation was established in 1995 with the sole mission to raise philanthropic support for the work carried out at the Institut Jantung Negara.

The event was held at the Headquarter of MBG Fruits Sdn Bhd, the largest convenient fruit stores retailer in Malaysia (and a portfolio company of COPE). Guests to the party were invited to partake in the sumptuous durians, as well as to sample and purchase premium imported fruits marketed by MBG. Mr Adnan Lee, founder and CEO of MBG, was present to share his deep knowledge and experience in the fruits business with attendees.

By the end of the fruitful day, thanks to the generous donation from guests and staff, COPE managed to raise RM7,440 for the IJN Foundation.

Representatives from the IJN Foundation, Ms NorAini and Ms Rittzawati

Representatives from the IJN Foundation, Ms NorAini and Ms Rittzawati

Industry: Good PE investment prospects on the horizon

By Oliver Christopher Gomez, The Edge Malaysia

Bank Negara Malaysia raised the overnight policy rate (OPR) to 3.25% last month, resulting in higher bank lending rates. This may be good news for local private equity (PE) players as business owners and entrepreneurs may turn to alternative sources of funding.

COPE Private Equity managing director Datuk Azam Azman, for one, thinks good investment prospects are bound to show up in the local market, and that businesses that cater for the mass market will be attractive prospects for PE investments. “Sectors that fulfil large consumer needs such as energy, healthcare, education, food production and peripheries, like medical devices and engineering maintenance services, will continue to dominate growth,” he says.

He adds that key to these companies’ success will be ensuring consistent revenue growth while managing efficient cost management protocols.

Nonetheless, Azam believes that potential portfolio companies in the consumer sector will face increased pressure to maintain brand loyalty as consumers now have access to a wider variety of options, thanks to disruptive technologies. “We cannot ignore the threat and need to embrace these [disruptive technologies] in our investment portfolios,” he says.

Meanwhile, industries that are overly reliant on old technology and labour-intensive production as well as those that suffer from cyclical business headwinds, such as property development and building materials, are to be avoided, says Azam. “We do not invest in property and construction-related companies as this is a capital-intensive sector with long gestation periods and relatively thin profit margins.

“Commodity companies, on the other hand, are inherently dependant on exogenous factors such as global economic cycles, over which our team has little control. Where possible, we would like to be in control of our own destiny.

“As for start-ups, they are essentially experiments on new business models. Thus, these high-risk investments should be left to those with specialised knowledge such as venture capital firms.”

Azam says COPE prefers companies in the food and beverage (F&B), education, healthcare and energy sectors. “We typically look at those with normalised profit after tax of more than RM10 million.”

The firm’s recent investments include a 2016 entry into MBG Fruits, one of the country’s largest fruit retailers, which has a significant presence in shopping malls, public transport hubs and hospitals. Last year, the firm invested in My-Sutera Holdings Sdn Bhd, a uniform manufacturer, distributor and owner of the “Canggih” brand of school uniforms.

COPE’s investing approach has worked out well so far. “As at the fourth quarter of last year, the COPE-KPF Opportunities 1 — our 2006 evergreen fund — achieved an internal rate of return (IRR) of 13.9%, with a realised money multiple of 1.7. COPE Opportunities 2 — a 2012 fund — achieved an IRR of 52.4%, with a realised money multiple of 3.5. Both funds have more than returned the initial funding commitment as well as preferred returns to investors,” says Azam.

Last month, the firm made a successful exit from Serba Dinamik Holdings Bhd after a four-year investment period with the integrated and specialised engineering services company. It had invested RM35 million in a subsidiary of the company in June 2013 via its two funds.

After helping the subsidiary internationalise its operations, Serba was able to grow its revenue by 4.9 times and net profit by 5.3 times. As at September last year, Serba’s revenue and profit after tax stood at RM1.9 billion and RM227 million respectively.

A whopping 71% of Serba’s revenue came from its international operations, up from 45% in 2013. At the point of exit, COPE had generated an IRR of 79.2% and a money multiple of 8.9 on the capital invested.

Although business is on the rise at COPE, senior vice-president of investments Badrul Hisham Jaafar admits that the PE sector is not without its own challenges. “One of the trends we have noticed is large institutional investors consolidating PE investment mandates into a few mega funds, with fund sizes exceeding US$1 billion to US$2 billion. At the end of the day, it takes a lot of resources for institutional investors to select, approve and monitor investments in PE funds, so we understand the move,” he says.

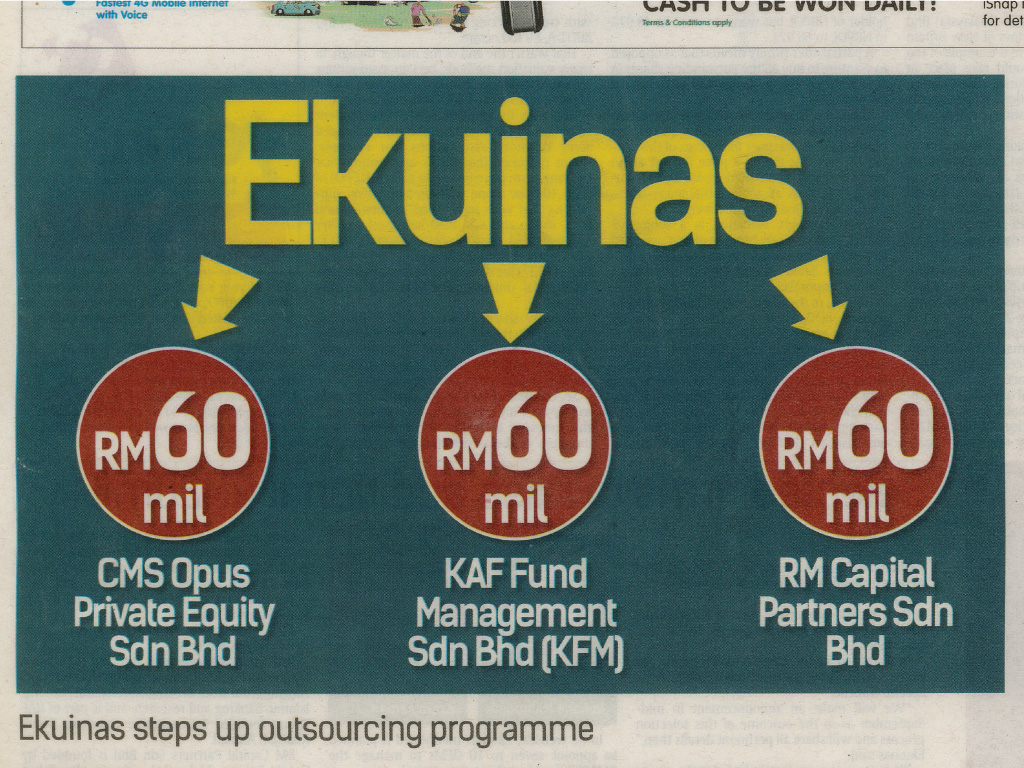

“As a relatively small and homegrown PE firm, COPE has no choice but to grow in size and geographical reach if we are to thrive in the long term. To this end, we have invested in proprietary IT systems over the last few years as well as gained access to private company databases with the help of one of our institutional investors — Ekuiti Nasional Bhd (Ekuinas). We have also worked with external consultants to benchmark our team against global standards.”

Azam says the firm is also considering the possibility of setting up an office abroad, although he admits that the move is still some way off in the future.

Exiting investments

According to Azam, COPE’s expertise lies in helping portfolio companies “institutionalise”. This is done by implementing top-notch corporate governance procedures, investing in IT systems, securing intellectual property (IP) rights for portfolio company prototypes and technologies, implementing operational key performance indicators (KPIs) and developing incentive schemes for second liners in the portfolio companies.

“As a local PE firm, we are heavily invested in the domestic economy. However, if economic growth barely ticks above 5%, how are we supposed to make returns for our investors?

“So, we look at the revenue sources of our portfolio companies: how much comes from home and how much is derived from overseas markets? Looking at the current economic environment, for example, we discuss with the business owners then chart a road map to increase revenue from their overseas markets.”

Once COPE and its portfolio company have agreed to the overarching business objective, the team looks at the company’s fundamentals. “We go through its balance sheets, financial statements and may, for instance, discover that most of its revenue comes from just one source — ad hoc engineering projects. This will be a problem for us as the company does not have any other revenue streams to fall back on. Then, we would consider new business streams that it can capitalise on without straying too far from its core competencies,” says Badrul.

With all the money, time and effort poured into supercharging the portfolio companies, Azam naturally has high expectations. According to him, the firm expects a standard return of 20% over a three to five-year period. “But really, if we can, we want to double our investment by the end of the timeline,” he says.

Revamping the portfolio company’s business objectives and processes is just one part of the equation, however. COPE also makes it a point to institute employee share option schemes at its portfolio companies. This way, if a portfolio company is listed, deserving staffers are suitably incentivised to ensure the company’s continued success.

But bringing the best business sense and strategic know-how counts for very little if the founders are not willing to commit to what is often a very radical change. “Having a PE firm investing in your business is like getting into a marriage. Having the right chemistry is important as we are then able to minimise ‘marriage issues’ between us and the founders,” says Azam.

He adds that portfolio company founders need to be leaders or “near leaders” in their respective fields. They must also display a range of technical competencies.

“The founders need to have a strong grasp of the technology, distribution channels and branding. Also, they need to have that relentlessness that often characterise the best entrepreneurs of the day,” says Azam.

“We want people who are capable, credible and open to new ideas.”

Although COPE is a relatively new entity, the firm traces its roots back to 2005, when it was established as CMS Opus Private Equity. It changed its name last month to be more in line with the names of its various funds, as well as to distinguish itself from its sister company, Opus Asset Management, which specialises in fixed-income investments.

COPE is one of the few shariah-compliant private equity fund managers in the region.

Read more here

Malaysia’s COPE nears target for fourth fund

By Carmela Mendoza, Private Equity International

COPE Private Equity, a Malaysia-focused private equity firm, has raised MYR 275 million ($70 million; €56 million) towards a MYR 300 million target for its fourth fund, Private Equity International has learned.

The firm launched COPE Opportunities 4 in 2016 and held a first close on MYR 200 million in October 2017 and a second close on MYR 275 million in early January this year, a source with knowledge of the fundraising told PEI. A final close is expected by the third quarter of the year.

The fund is almost four times larger than its predecessor, COPE Opportunities 3, a 2013-vintage vehicle that closed on MYR 80 million and is currently being deployed.

The firm’s existing investors, mainly Malaysian public pension funds and corporations, have backed its latest offering, the source added.

COPE Private Equity, previously called CMS Opus Private Equity, typically backs consumer, manufacturing and oil and gas companies in Malaysia.

The firm exited its investment in engineering services company Serba DInamik in January 2018, generating a money multiple of 8.9x and an internal rate of return of 79.2 percent for its investors, the firm wrote on its website. COPE invested MYR 35 million in the company in June 2013 via two of its funds: COPE-KPF Opportunities 1 and COPE Opportunities 2.

COPE Private Equity manages five private equity funds of more than MYR 500 million. As of Q4 2017, MYR 150 million COPE 1 and MYR 61 million COPE 2 have achieved gross IRR of 13.9 percent and 52.4 percent, with realised money multiple of 1.7x and 3.5x respectively.

Read more here

COPE Private Equity exits Serba Dinamik

Kuala Lumpur, Monday 29 January 2018 : COPE Private Equity (COPE) fully exited Serba Dinamik Holdings Berhad (Serba) in January 2018, capping a successful 4-year investment in the integrated and specialised engineering services company.

COPE invested in a subsidiary of Serba for MYR35 mil (USD9 mil) in June 2013 via two of its private equity funds: COPE-KPF Opportunities 1 and COPE Opportunities 2.

Successful international expansion

Over the period of COPE’s investment, Serba grew its revenue 4.9-fold and net profits 5.3-fold. For the 9 months ending 30 September 2017, Serba’s revenue and PAT was MYR1.9 bn (USD490 mil) and MYR227 mil (USD59 mil) respectively.

The foundation of Serba’s growth was the result of a concerted push to develop business outside its home market of Malaysia to the Middle East, Indonesia, and the United Kingdom. For the 9 months ending 30 September 2017, 71% of Serba’s revenue was contributed from its international operations, up from 45% in 2013.

Final result

The decision to divest Serba was made in view of the approaching maturity of both private equity funds. With the full exit in January 2018, COPE has more than covered the cost of its investment, generating IRR of 79.2% and money multiple of 8.9x on the capital invested.

Dato’ Dr IR Mohd Abdul Karim,Group Managing Director and Group CEO of Serba Dinamik, said: “We are grateful to the COPE team for their strategic guidance and counsel. They have played an integral role in helping us to execute our international expansion.”

Dato’ Azam Azman, Managing Partner of COPE Private Equity, said:“We are privileged to work with the exceptional management team led by Dato’ Dr IR Mohd Abdul Karim. With a strong track record and record order book, we are confident Serba Dinamik will continue to scale new heights.”

Ends.

About Serba Dinamik Holdings Berhad

Founded in 1993 by Dato’ Dr IR Mohd Abdul Karim, Serba Dinamik is an energy services group that provides engineering solutions to the oil and gas (O&G) and power generation industries. Its main activities include operations and maintenance (O&M) services and engineering, procurement, construction and commissioning (EPCC) works.

About COPE Private Equity

Founded in 2005 and led by Dato’ Azam Azman, COPE Private Equity (Formerly known as CMS Opus Private Equity) is a Malaysia based private equity firm focused on making investments in small and midcap growth companies with regional presence. COPE have been active in the market since 2006 with AuM of over MYR500 mil (USD130 mil) over 5 funds.

CONTACT

Gavin Tan

gavintan@copepartners.com

Tel: +6(0)2031 9008

CMS Opus Private Equity changes name to COPE Private Equity

Effective today, CMS Opus Private Equity shall be known as COPE Private Equity. As the firm prepares for its next chapter of growth, the name change will represent a fresh identity and perspective.

Launch of website

In conjunction with the change of name, COPE Private Equity is pleased to announce the launch of its corporate website at www.copepartners.com.

Dato’ Azam Azman, Managing Partner of COPE Private Equity, said:

“We are delighted to announce the launch of our new name, COPE Private Equity.”

“With a seasoned team, excellent track record and proven strategy, we shall continue to do our best in generating outstanding returns for investors. Thank you for your continuous support and confidence in us for the past 12 years.”

Ends.

About COPE Private Equity

COPE Private Equity is a mid-market private equity firm established in 2005 with assets under management (AuM) of over MYR500 million. To date, the firm has delivered excellent results for investors:

- Preqin, the leading alternative assets publication has identified COPE Opportunities 2 as the top 5 Best Performing Growth Funds globally¹.

- The Centre for Private Equity Research has awarded COPE Private Equity with the top exit performance in H1, 2017 in South East Asia with Money Multiple of 7.3x².

¹ Data as at Q3, 2017 for funds established between 2010 and 2014

² On the listing of an investee company of COPE 1 and COPE 2 on 8 February 2017 on Bursa Malaysia

CONTACT

Gavin Tan

gavintan@copepartners.com

Tel: +6(0)2031 9008

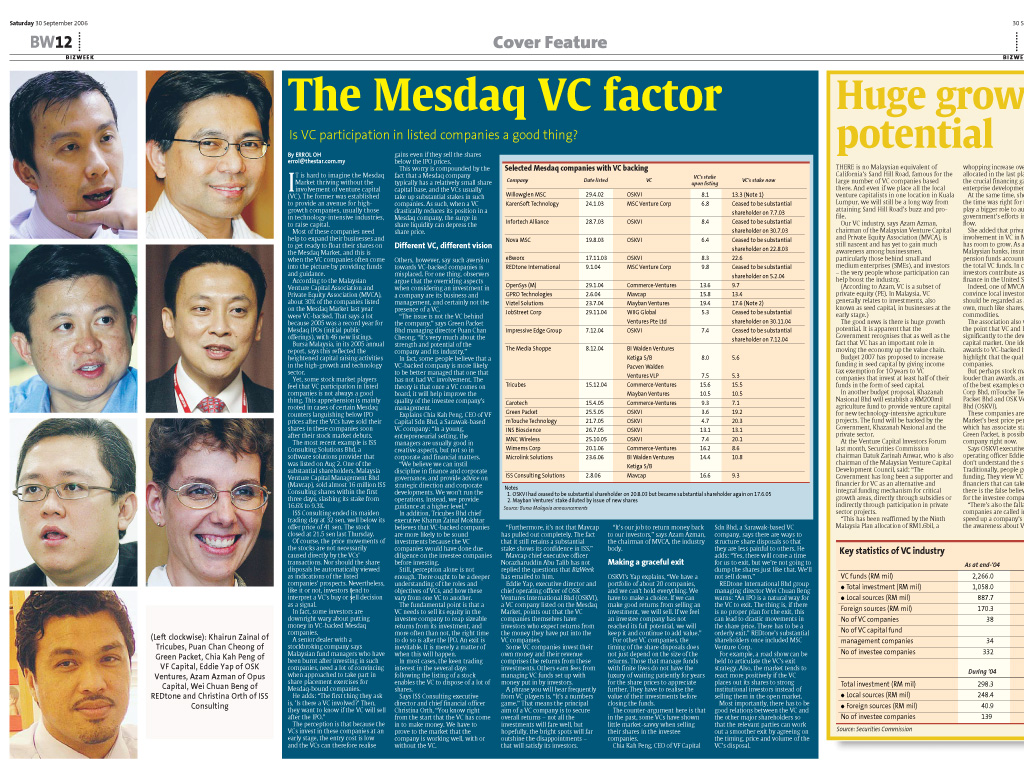

Serba Dinamik on path of steady growth

TEN months since its flotation on Bursa Malaysia, Serba Dinamik Bhd is showing the kind of steady growth that its initial public offering (IPO) investors must be pleased with.

On Thursday, the stock hit RM3, which is exactly double its listing price of RM1.50 a unit. This has led its market capitalisation to double since then to RM4bil, making it one of the larger listed engineering firms on Bursa Malaysia.

This week, Serba Dinamik, which undertakes operation and maintenance (O&M) as well as engineering, procurement, construction, and commissioning (EPCC) works for oil and gas projects, posted its nine-month net profit of RM229.5mil, which already makes up 93% of its previous full year results.

The nine-month net profit, which represents a 44.6% year-on- year growth, was also above consensus estimates.

Serba Dinamik, which traces it roots to Sarawak with Cahya Mata Sarawak Bhd’s private equity arm CMS Opus PE Sdn Bhd also being a 16.1% shareholder, has an impressive client base, with an estimated 57% of its revenue coming from the Middle East. That turned out to be a concern this mid-year, when Saudi Arabia, Egypt, the United Arab Emirates and Bahrain decided to cut ties with Qatar over allegations that it was supporting terrorism.

However, this has not been a problem as Serba Dinamik group managing director and CEO Datuk Mohd Abdul Karim Abdullah explained then that the company’s O&M services in the Middle East were not affected by the Gulf tensions.

“We are gearing up for opportunities to possibly provide our support to gas producers in Qatar, due to the vacuum of contractors from the countries pulling out of Qatar.

“The situation has not jeopardised the logistics of selling oil to the buyers, namely, South Korea, India, Japan, and China, among other countries,” he said.

As of the third quarter ended September 30, Qatar remains as Serba Dinamik’s second largest contributor by country, contributing 23% of the total revenue, at RM150.91mil. Revenue contribution from Qatar was at 16% in the full financial year 2016.

The bulk of the company’s earnings is still derived from Malaysia, via O&M services, as well as its water treatment plant EPCC contract in Kuala Terengganu.

Malaysia contributed RM201.8mil or 28.9% of the total revenue during the third quarter. Total revenue and net profit for the group’s third quarter stood at RM653.32mil and RM68.03mil.

In its latest quarterly filing, Serba Dinamik says remains optimistic about its future prospects and expects that the group will continue to generate positive results for the year.

It announced last month that the group will be establishing a chor-alkali plant in Tanzania, through a partnership with Junaco (T) Ltd. A chor-alkali plant produces chlorine and sodium hydroxide, which are commodity chemicals.

This will mark Serba Dinamik’s maiden venture into Africa and the company looks to further grow the business in the region.

“It also reaffirms our plan to grow the asset ownership business model, which would lead to further enhancement of our EPCC and O&M capabilities.

“Apart from expanding our asset base, the company has also managed to secure various new contracts as well as manage to obtain renewals for some of its existing contracts in the O&M and EPCC segment.

“In order to ensure the company’s continuous growth, the group plans to leverage on its core competencies of operating within both the oil and gas and power generation industries, as well as expanding into water treatment and utilities industry,” said Serba Dinamik. Apart from

that, Serba Dinamik announced that its wholly-owned subsidiary Top Luxury Sdn Bhd, has been awarded a contract to undertake the construction works for the Pengerang eco-Industrial Park (PeIP), pursuant to its Pengerang development plan in August this year.

The contract, valued at RM400mil, include the establishment of Malaysia’s first maintenance, repair, and overhaul (MRO) and inspection, repair, and maintenance (IRM) Global Centre of Excellence.

Construction work is due to commence by the first quarter of 2018 and will take approximately two years to complete.

Read more at here

CMS Opus invests $4.5m in My-Sutera; exits Damini, Delta Express

Malaysia’s CMS Opus Private Equity (COPE) has invested $4.5 million (MYR 20 million) in the country’s largest school uniform maker My-Sutera even as it made two investment exits from water meter firm Damini Corporation and logistics provider Delta Express in the first quarter of this year.

In an announcement, the private equity investment arm of Cahya Mata Sarawak said it “had a busy first four months of 2017, successfully finalising a number of investment exits and undertaking of new strategic investments in growing consumer segments.”

The investment in My-Sutera, that has two well known brands “Canggih” and “Ammaro,” is expected to propel it to become the number one producer of school uniforms in Malaysia. “The investment would also assist the company to further expand its product lines and to enter new markets,” it said.

The investment indicates the firm’s confidence in the consumer market in Malaysia. In fact, COPE has invested in fresh fruits retail chain MBG Fruits picking up a 31.5 per cent stake in the company last year. That was a debut in the retail segment for the private equity firm. Other than school uniforms, Shah Alam-headquartered My-Sutera also produces corporate uniforms and has embarked into specialised fire retardant material-based uniform for use by fire brigades, military personnel, shipboard engineers, chemical plants and the like.

Meanwhile, with regard to exits, COPE made an exit from its 29.37 per cent equity stake in Damini Corporation on March 31, 2017 via redeemable convertible preference shares. The firm had invested Damini, a major supplier and distributor of water meters and metering solutions, in 2015.

Further, COPE also successfully exited from its effective equity stake of approximately 45 per cent in logistics forwarding and shipping service provider, Delta Express on April 17, 2017. All investments in Delta, which is a subsidiary of Swift Haulage Sdn Bhd, were made via redeemable convertible preference shares.

Read more here

PE-backed Serba Dinamik debuts at Bursa, raises $135m from IPO

CMS Opus Private Equity-backed engineering solutions provider Serba Dinamik on Wednesday listed on the Malaysian stock exchange, marking a steady debut. Serba Dinamilk’s offering is the biggest IPO for Malaysia since 2015.

The firm that listed on the Bursa Malaysia to raise over $130 million, had offered a public issue of 26.7 million shares under its IPO which had been oversubscribed by 4.96 times. The stock opened at MYR1.53 on February 8 on the day as compared to the offer price of MYR1.50 per share.

The company provides solutions to the oil and gas (O&G) as well as power industries has a total market capital of over MYR2 billion. Private equity firm CMS Opus had invested in Serba Dinamik in 2013 and sold a portion of its interest as part of its the listing exercise, the private equity firm said in a statement on Friday. Serba Dinamik, currently has tendered for about MYR5 billion worth of EPCC jobs in Pengerang, Johor and the group is awaiting the outcome of its bids, which is expected to be revealed within the next six months.

“Theoretically I can say that more contracts are coming in. In Malaysia, as you can see in the last one week, oil and gas companies have been announcing awards being received,” the company’s Managing Director and CEO Datuk Ir Mohd Karim Abdullah had said on the day of listing.

About 60 per cent the firm’s revenue is generated from its operations in the Middle East, while the rest is from local activities. In fact, CMS Opus has assisted the company’s regional expansion particularly in Indonesia and Middle East.

Read more here

Malaysian PE firm CMS Opus makes retail debut, picks 31.5% in MBG Fruits

Malaysian private equity firm CMS Opus Private Equity Sdn Bhd has picked a 31.5 per cent stake in fresh fruit business MBG Fruits Sdn Bhd, for an undisclosed amount, marking its debut in the retail sector.

In an interview with DEALSTREETASIA, MBG founder and chief executive officer Adnan Lee said, he and his mother remain the majority shareholders in the company, holding 68.5 per cent. Both Lee and CMS Opus declined to reveal the total investment made by the private equity firm.

The MBG deal was done under national private equity management firm Ekuiti Nasional

Bhd’s (Ekuinas) Outsource Programme, as CMS Opus is among the outsource partners, Lee mentioned. CMS Opus is the private equity unit of Cahya Mata Sarawak Bhd.

The PE firm has previously invested in the oil & gas sector, engineering and manufacturing companies and even a water treatment chemical distributor. It had in April last year divested entirely from the oil and gas sector.

Although the firm has said that it has been working on diversifying its portfolio, an executive at CMS Opus told DEALSTREETASIA that it was not a formal strategy to go into the retail sector but rather an effort in spotting an unrivaled investment opportunity in MBG.

“We did not plan to go into retail. Our investments are made on a case by case basis. Retail is generally very competitive, we have to see what the competitive advantages each business has,” he said.

In recent months, a few other private equity firms have been investing in grocery businesses, such as Navis’ investment in BIG Independent Grocer, CIMB Private Equity and Mitsubishi Corp’s deal in Jaya Grocer, and KV Capital’s investment in TF Value Mart.

Explaining the rationale behind investing in MBG, the executive noted that the MBG business model is a blue ocean strategy. “They penetrated into a segment where no other players were in. They have expanded to a size where there are no other competitors within the convenience fruits retail concept operating within that size. The perishable retail industry is a hard segment to manage,” he added.

When asked why the company decided to take on private equity capital after two decades of operating, Lee admitted that MBG had not been actively looking for capital. “They approached us. I had not known about private equity or venture capital prior to this,” Lee said. Lee took over his grandfather’s fruit retailing business in 1994 in the wet markets, and expanded the business into malls in 2004.

MBG has grown into a company with various departments like finance, human resource,

marketing, operations and more. Lee felt that it made sense for the company to engage

better expertise in certain areas where its core team lacked expertise. “With CMS Opus, we

can strengthen our finance team,” he added. Lee noted that despite having CMS Opus on board as a notable shareholder, he will continue to steer the direction of the company.

With the investment, MBG aims to open another 50 outlets focused around Klang Valley over the next five years. “For the past 10 years, we have mostly grown through internal cash flow. This investment will give the company enough capital to open another 50 outlets without utilising the company’s cash flow,” he said. The group now runs 32 outlets in the Klang Valley.

Beyond Malaysia, MBG has plans to expand into Indonesia. Lee said, the group will look at how to integrate technology into its business plans, but will need to build a team of experts for that to happen. “We will need a different team and strategy to do that. We need to know how to sell and how to manage our perishable products online. It’s not easy. For a lot of the grocery delivery businesses, fresh food remains a small portion of the customers’ purchase,” he said.

On the company’s finances, Lee said, “the group, on the whole, has been making profit.” The executive from CMS Opus noted that the group’s revenue momentum is not slowing down. The group’s revenue for FYE 2015 is MYR56.7 million, growing at a CAGR of 19.4 per cent from 2013 to 2015.

Read more here

CMS Opus divests all O&G investments, to amp up diversification strategy

CMS Opus Private Equity Sdn Bhd has completely divested from its oil & gas investments and will further focus on diversifying into other industries, an executive aware of the development said.

The executive quoted above confirmed to DEALSTREETASIA that the firm is further

expanding its portfolio to cover broad-based sectors, to diversify and broaden quality asset opportunities for the portfolio.

The move to diversify began in 2013, this executive said, while adding that this would continue to underpin the firm’s strategy. The sectors could include engineering services, industrial products manufacturing, food manufacturing, healthcare and medical devices manufacturing and services, education, and general fast moving consumer goods retail businesses with high growth prospects.

It was not clear if the firm will reinvest in the oil & gas sector, but this executive, who declined to be named, alluded that CMS Opus would not be discounting opportunities there. According to parent company Cahya Mata Sarawak’s 2014 annual report released on April 8, CMS Opus has to date, seven investee companies in its portfolio with a current asset under management (AUM) totalling MYR291 million ($80.2 million).

For the financial year 2014, CMS Opus returned investment capital amounting to MYR10.17 million ($2.8 million). In January this year, the firm exited its 2011 investment in Trisystems Engineering Sdn Bhd, with a capital return of MYR22,212,688 ($6.2 million) representing an internal rate of return of 30.03 per cent and a money multiple return of 2.47 times.

CMS Opus acquired a 20 per cent stake in Trisystems in April 2011 for MYR9 million ($2.5 million), through its COPE-KPF Opportunities 1 fund. Trisystems is leading in the field of process instrumentation and control, filtration and combustion in Malaysia. It also offers automation systems, process packages solutions and provides custom engineering design, assembly, testing, installation, commissioning, support and training primarily for the oil and gas industry. CMS Opus’ investment has benefited Trisystems in securing double digit growth over the span of the investment horizon.

In March this year, CMS Opus acquired a 30 per cent stake in utility and water related player Damini Corporation Sdn Bhd through its COPE Opportunities 2 fund. The proceeds from the investment will be utilised for merger and acquisitions and as growth capital. The principal activity of Damini is supplying chemicals, reagents, equipment for water treatment, water meters, engineering services to the water distributors, chemical solvents and marine gas oil for the oil and gas industry.

Local media had reported that Damini plans to grow through acquisitions, supported by CMS Opus’ capital injection. Damini also intends to pursue a listing in the next two to three years. “In terms of profit track record, we have already met the quantitative requirement,” group managing director Borhanuddin Ramli told local media earlier. “However, we would like to further strengthen the qualitative aspect of the requirement before we apply for a listing,” he had added. The company reported a turnover of MYR130 million last year, with 70 per cent coming from its water industry operations and remaining 30 per cent being contributed by its activities in the oil and gas segment.

CMS Opus is a sharia-compliant private equity firm jointly established by Cahya Mata Sarawak and investment advisory firm Opus Capital Sdn Bhd in 2006. The firm primarily looks at opportunities in unlisted emerging growth companies in Malaysia and the Asean region. Its related company, Opus Asset Management Sdn Bhd specialises in fixed income investment and has a current asset under management of MYR2.53 billion ($702 million) as at December 2014. Cahya Mata Sarawak is an extensive infrastructure facilitator in the state of Sarawak in eastern Malaysia.

Read more at here

- Contact us

If you think we will be a good fit for your fund or business, please write to us. We would love to hear from you.

Our Location

COPE Private Equity Sdn Bhd

Office Suite 1, Level 8, Ilham Tower, No 8, Jalan Binjai, 50450 Kuala Lumpur, Malaysia.